Value-added Small Fruit and Berry Initial Grower Survey Results

as of October 31, 2020

By Dr. Wan-Yuan Kuo and Sumedha Garg, Montana State University Food Product Development Lab, and Western Agricultural Research Center. Contact Dr. Wan-Yuan Kuo.

Are you a berry or small fruit grower? We’d like to learn more about your farm! Take this 5-minute survey.

Overview

The Montana State University Food Product Development Lab and Western Agricultural Research Center are surveying to understand small fruit and berry growers’ needs and interests in the value-added market. This report presents the current survey results.

- The sample size of growers who filled in the survey = 71

- Growers from across various US states (Montana, Minnesota, Missouri, Utah, New York, Ohio, Oregon, Illinois, Utah, Wisconsin) and even from Canada, filled in the survey.

- Survey questions

- What are the top research and workshop topics on small fruits that you would be most interested in?

- What are your top choices for the product development of small fruits?

- What are the aspects which you believe to be most important in the product development of small fruits?

- What fruit crops have you planted or are planning to grow?

- Please describe your current operation

Responses

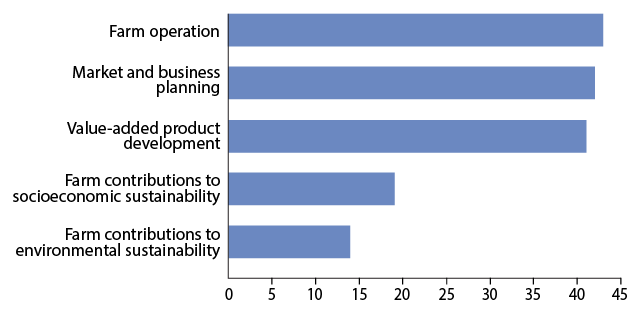

Q1. What are the top research and workshop topics on small fruits that you would be most interested in?

The top research or workshop topics among the small fruit growers who participated in the survey included the following:

- Farm operation (e.g., planning, planting, nutrient management, pest and disease management, equipment selection): 27.0%

- Market and business planning: 26.4%

- Value-added product development: 25.8%

- Farm contribution to socioeconomic sustainability (e.g., agritourism): 11.9%

- Farm contribution to environmental sustainability (e.g., cross-pollination or crop diversity): 8.8%

Within farm operation, growers wanted to gauge a better understanding of pest & disease management and equipment sizing.

Within market and business planning, growers indicated the preference to learn about grant writing, permitting, licensing and marketing of winery and freeze dried fruit.

Number of survey respondents for Q1:

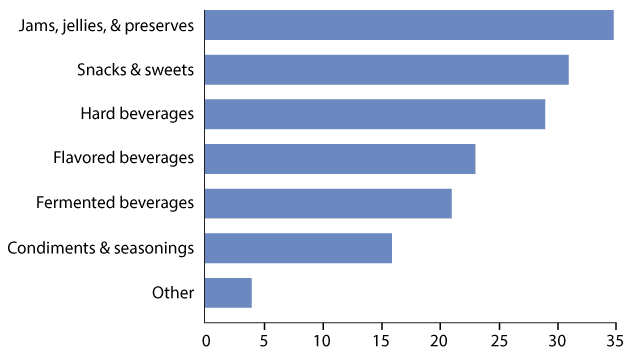

Q2: What are your top choices for the product development of small fruits?

The top choices for product development within small fruits included the following categories:

- Jams, jellies, and preserves: 22.0%

- Snacks & sweets (granola, candies, freeze-dried fruits): 19.5%

- Hard beverages: 18.2%

- Flavored beverages (seltzer, juices, shakes, fruit tea, etc.): 14.5%

- Fermented beverages (kombucha, cider etc): 13.2%

- Condiment, sauce, dressing, seasoning, etc.: 10.1%

- Other: 2.5%

Within others: some growers were interested in options of freeze dried (aseptic puree), frozen product ideas and/or dairy products. A respondent also expressed interest in food dyes/natural cosmetics.

Number of survey respondents for Q2:

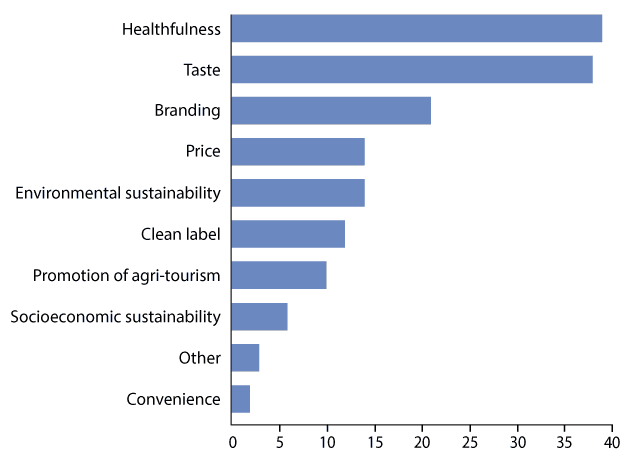

Q3. What are the aspects which you believe to be most important in the product development of small fruits?

The top aspects that growers’ found were of most significance in product development:

Healthfulness (e.g. minimally processed, organic, natural): 24.5%

Taste: 23.9%

Branding (e.g. Made in Montana): 13.2%

Environmental sustainability: 8.8%

Price: 8.8%

Clean label (recognizable ingredients): 7.5%

Promotion of agri-tourism: 6.3%

Socioeconomic sustainability: 3.8%

Other: 1.9%

Convenience: 1.3%

Number of survey respondents for Q3:

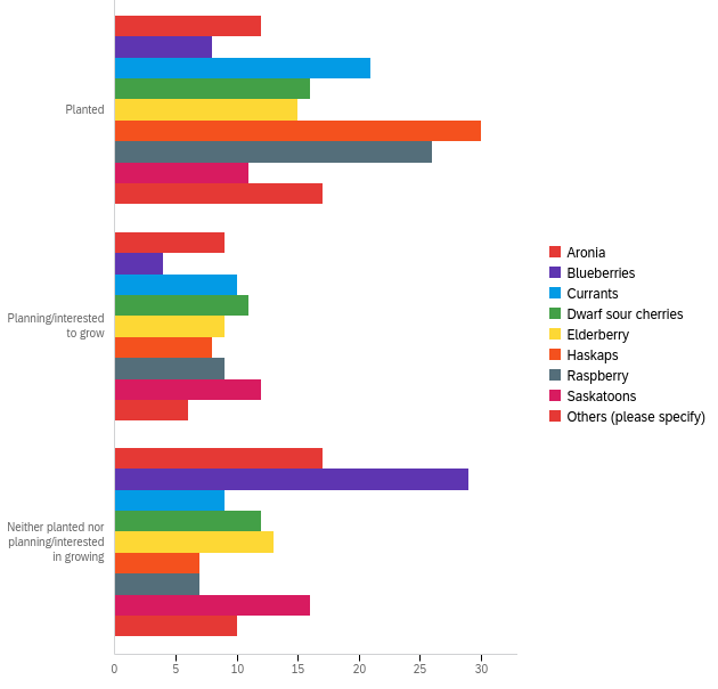

Q4. What fruit crops have you planted or are planning to grow?

Out of the small fruit & berry crop options provided:

- Haskap, raspberry and currant were most commonly grown.

- Interest for growing the various berries was more or less similar among the population, but a relatively larger proportion (approximately 30%) were interested to grow haskaps and dwarf sour cherries.

- A very large proportion of growers didn’t have plans/intentions to grow blueberries. A small proportion also didn’t have plans/intentions to grow aronia and saksatoons, either.

Table showing number of survey respondents for Q4:

Note: Data appears to be skewed for states of Montana and Utah, as majority of the participation for the survey was from these two areas.

|

Total |

Canada |

ID |

IL |

MN |

MO |

MT |

NY |

OH |

OR |

UT |

WI |

Not in the US |

||

|

Saskatoons |

Planted |

11 |

2 |

0 |

0 |

2 |

0 |

5 |

0 |

0 |

0 |

1 |

1 |

0 |

|

Planning/interest to grow |

12 |

0 |

0 |

1 |

1 |

1 |

7 |

0 |

0 |

0 |

2 |

0 |

0 |

|

|

Haskaps |

Planted |

30 |

5 |

0 |

0 |

3 |

2 |

13 |

1 |

1 |

0 |

2 |

1 |

1 |

|

Planning/interest to grow |

8 |

1 |

0 |

1 |

1 |

0 |

5 |

0 |

0 |

0 |

0 |

0 |

0 |

|

|

Aronia |

Planted |

12 |

1 |

0 |

0 |

2 |

0 |

5 |

1 |

1 |

0 |

1 |

1 |

0 |

|

Planning/interest to grow |

9 |

1 |

0 |

1 |

1 |

1 |

4 |

0 |

0 |

0 |

0 |

0 |

1 |

|

|

Blueberries |

Planted |

8 |

0 |

0 |

1 |

1 |

2 |

1 |

0 |

1 |

1 |

0 |

1 |

0 |

|

Planning/interest to grow |

4 |

1 |

0 |

0 |

0 |

0 |

2 |

0 |

0 |

0 |

1 |

0 |

0 |

|

|

Raspberry |

Planted |

26 |

3 |

0 |

1 |

2 |

0 |

11 |

0 |

1 |

1 |

6 |

1 |

0 |

|

Planning/interest to grow |

9 |

1 |

0 |

0 |

0 |

1 |

4 |

0 |

0 |

0 |

3 |

0 |

0 |

|

|

Elderberry |

Planted |

15 |

0 |

0 |

1 |

2 |

0 |

5 |

1 |

1 |

0 |

4 |

1 |

0 |

|

Planning/interest to grow |

9 |

1 |

0 |

0 |

0 |

1 |

5 |

0 |

0 |

0 |

2 |

0 |

0 |

|

|

Dwarf Sour Cherry |

Planted |

16 |

1 |

0 |

0 |

2 |

1 |

8 |

1 |

1 |

0 |

2 |

0 |

0 |

|

Planning/interest to grow |

11 |

0 |

0 |

1 |

1 |

0 |

4 |

0 |

0 |

1 |

2 |

1 |

1 |

|

|

Currants |

Planted |

21 |

1 |

0 |

0 |

2 |

0 |

11 |

1 |

1 |

1 |

2 |

1 |

1 |

|

Planning/interest to grow |

10 |

1 |

0 |

1 |

0 |

1 |

4 |

0 |

0 |

0 |

3 |

0 |

0 |

Graph showing number of survey respondents for Q4:

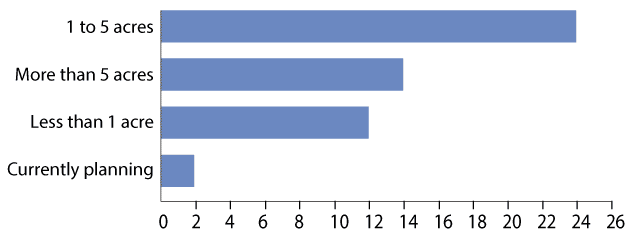

Q5. Please describe your current operation.

The below figures indicates the current operation for the growers who filled in the survey:

Of the 52 growers, majority of the farmers (=46.2%) had a farm between 1 to 5 acres, whilst 23.1% and 26.9% had less than 1 acre and more than 5 acres of land, respectively. Remainder were still in the planning stage.